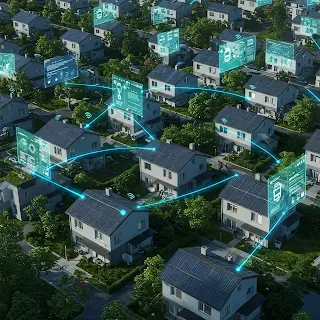

As the world accelerates its transition toward clean energy, one of the biggest hurdles remains — efficient and transparent energy trading. Enter blockchain, a digital ledger technology revolutionizing not just finance but also how renewable energy is produced, distributed, and traded. Blockchain-based green energy trading is rapidly emerging as a game-changer by decentralizing energy markets, reducing costs, and ensuring transparency.

🔗 What is Blockchain-Based Green Energy Trading?

Blockchain-based green energy trading involves the use of decentralized, tamper-proof ledgers to record and execute transactions in renewable energy markets. This system allows prosumers (producers and consumers of energy) to buy, sell, or exchange excess solar, wind, or hydro power in real time without the need for traditional intermediaries.

Key Characteristics:

-

Peer-to-peer (P2P) transactions

-

Smart contracts for automation

-

Transparent and auditable data

-

Real-time pricing and energy flow tracking

💡 Why Blockchain is a Perfect Fit for Renewable Energy

1. Decentralization

Traditional energy systems are centralized and heavily regulated. Blockchain allows localized microgrids and autonomous energy communities to trade power directly.

2. Trust and Transparency

Every energy transaction is recorded and immutable, reducing fraud and ensuring the authenticity of renewable energy certificates (RECs).

3. Smart Contracts

Automated smart contracts execute trades when pre-defined conditions are met—such as electricity price thresholds or time-of-use schedules.

4. Reduced Costs

By removing intermediaries like utilities or energy brokers, costs related to administration, transaction fees, and delays are minimized.

⚡ Real-World Use Cases

🔹 Power Ledger (Australia)

Facilitates peer-to-peer energy trading using blockchain. Users can sell excess solar energy to neighbors in real time.

🔹 WePower (Europe)

Allows companies to buy energy directly from producers via tokenized contracts, increasing transparency in power procurement.

🔹 Brooklyn Microgrid (USA)

A community-driven project where residents sell solar energy to each other using a blockchain platform.

🌐 Impact on Global Energy Markets

Blockchain is not just a technological upgrade; it's a paradigm shift. In developing nations with unstable grids and limited banking infrastructure, blockchain can democratize energy access. In mature markets, it can enhance grid stability and foster innovative pricing models.

🔒 Challenges and Limitations

• Regulatory Uncertainty

Governments are still adapting laws to accommodate blockchain energy platforms.

• Technical Scalability

Current blockchain systems may struggle with high transaction volumes and energy demand spikes.

• Energy Consumption

Ironically, some blockchains use significant energy. However, newer models (like Proof of Stake) are more sustainable.

🔮 Future Outlook

As the world races toward net-zero emissions, blockchain is poised to become a core technology for managing and monetizing green energy assets. With continued innovation in regulation, interoperability, and energy-efficient protocols, blockchain could very well become the backbone of tomorrow’s clean energy economy.

📚 Conclusion

Blockchain-based green energy trading holds immense promise in making renewable power more accessible, transparent, and economically viable. While challenges remain, the technology is already proving its value across multiple real-world applications. As climate urgency grows, embracing blockchain may be key to unlocking a resilient and democratized energy future.

No comments:

Post a Comment